A few weeks ago, the world of enterprise IT was jolted awake by the news of a proposed $61 billion acquisition of VMware by Broadcom. While the deal must still pass the scrutiny of regulators, the prospect of the single largest provider of virtualization technologies being consumed by a global conglomerate known primarily for manufacturing semiconductors has left IT leaders with more questions than answers.

Questions like: Will small and medium businesses be left out to dry? What impact will this have on customer support? What will this mean to the channel? And most notable of all, what will this mean to our licensing costs?

VMware customers have long grumbled about rising licensing costs and as Broadcom has already made plain, they plan to aggressively pursue across the board cost-cutting to improve their net margins – so no one should be too surprised to see a substantial hike when their annual bill comes due.

As Scale Computing co-founder and CEO Jeff Ready told CRN in this recent interview:

Broadcom has vowed to increase VMware profits from $4.7 billion to $8.5 billion. VMware’s main expense, like pretty much any software company, is people. ‘They’re gonna lay off like tens of thousands of people.’ That’s what’s going to happen. That’s your cost. Right? They’re not talking about tripling VMware’s sales. Their biggest costs are people and office space.

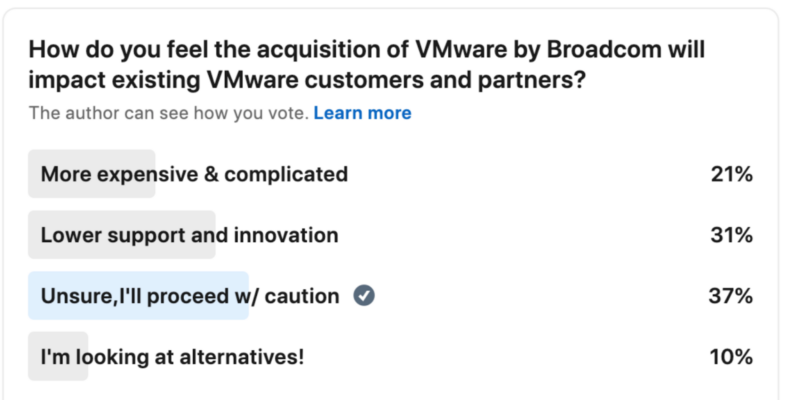

We recently conducted a flash poll on LinkedIn where we asked our industry peers what they think the impact of this acquisition might be. As the results below make abundantly clear, the future appears full of uncertainty and doubt.

Ultimately, the prospect of this acquisition begs another fundamental question: will the rush to profitability come at the expense of innovation? Matt Stoller, Director of Research at the American Economic Liberties Project and creator of the BIG newsletter on Substack which examines the monopoly crisis in America recently weighed in on this acquisition and what it might portend for users:

The history of Broadcom is instructive. CEO Hock Tan took over the firm in 1999, pursuing a string of acquisitions, such as LSI Corp, Brocade, Symantec, and CA Technologies. CA Technologies itself was the original IT roll-up artist, buying dozens of software firms, cutting costs, lowering software quality, and raising prices. Tan just does it on a bigger scale. I bolded the relevant parts for emphasis.

"He runs Broadcom like an investment portfolio ... they are all independent fiefdoms," said a former employee at the company who worked closely with Tan. "If he has a dominant position in any market, he'll go in and raise those prices."

Financial extraction and monopolization is the business model.

Many in the hardware industry that we cover know Broadcom-Avago’s game plan. They purchase companies like PLX that make PCIe switches. These are usually the best components in markets with few if any competitors. In these low competition markets, Broadcom raises prices and also puts heavy bundling burdens on hardware companies where supply or reasonable pricing are withheld

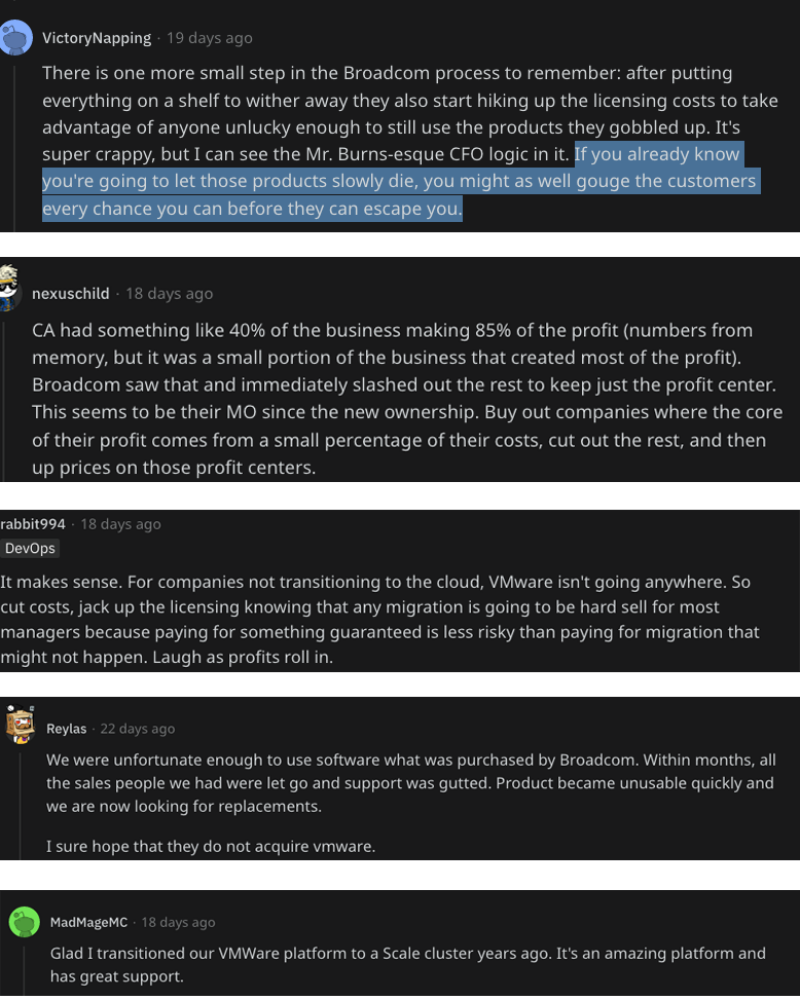

But perhaps the most revealing perspective on this acquisition comes straight from the people who use VMware products every day - system and network administrators. Here’s a quick roundup of comments gleaned from the r/SysAdmin page on Reddit, where a general sense of skepticism and suspicion abounds:

And to whoever ‘MadMageMC’ is, we both agree and appreciate your support

To see for yourself how Scale Computing is a more cost-effective VMware alternative, start your free trial today!